Introduction

Hindustan Zinc, a subsidiary of Vedanta Limited, is one of the world’s largest integrated manufacturers of zinc-lead. the company has a rich history spanning several decades. Over the years, Hindustan Zinc has not only established itself as a leading player in the metals and mining industry but has also managed to create significant value for its shareholders.

History of Hindustan Zinc

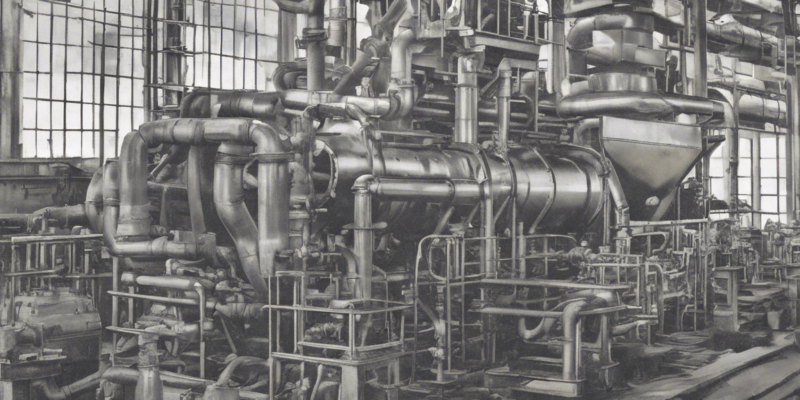

Established in the 1960s, Hindustan Zinc has emerged as a key player in the Indian mining industry, contributing significantly to the country’s overall zinc and lead production. The company operates multiple mines and smelting facilities in Rajasthan, India.

Business Model

Hindustan Zinc follows a robust and diversified business model that includes mining, refining, and marketing of zinc, lead, silver, and cadmium. The company’s operations are vertically integrated, starting from mining ore to producing refined metal.

Financial Performance

Over the years, Hindustan Zinc has consistently delivered strong financial performance, driven by its operational efficiencies, cost management, and strategic investments in technology and infrastructure. The company’s revenue and profits have shown a steady growth trajectory, making it a lucrative investment option for shareholders.

Dividend Policy

Hindustan Zinc has a progressive dividend policy that aims to reward its shareholders by distributing a significant portion of its profits in the form of dividends. The company’s dividend payout ratio has been consistently high, reflecting its commitment to creating value for its shareholders.

Dividend Payout

Dividend payout is a critical component of an investor’s total return. By distributing a part of its earnings to shareholders, a company like Hindustan Zinc can attract investors looking for regular income streams. The dividend payout not only provides immediate cash flow but also signals the company’s confidence in its future growth prospects.

Factors Influencing Dividend Payout

Several factors influence a company’s dividend payout decisions. These include:

– Earnings: Companies with stable and growing earnings are more likely to maintain or increase their dividend payouts.

– Cash Flows: Healthy cash flows are essential for sustaining dividend payments.

– Market Conditions: Economic conditions, industry trends, and market competition can impact a company’s ability to pay dividends.

– Regulatory Environment: Compliance with legal and regulatory requirements, including dividend distribution norms, is crucial.

– Future Growth Prospects: Companies need to balance dividend payments with investments in growth opportunities to ensure long-term sustainability.

Impact on Shareholders

For shareholders, dividend payouts offer a range of benefits:

– Regular Income: Dividend payments provide a steady income stream, especially for investors seeking passive income.

– Risk Mitigation: Dividend-paying stocks are perceived as less risky, as companies that pay dividends tend to be financially stable.

– Total Return: Dividends, when reinvested, can enhance the total return on investment over the long term.

– Value Creation: Companies that consistently pay dividends signal their financial strength and commitment to shareholder value creation.

Investor Considerations

Investors looking to maximize their returns through dividend investing should consider the following:

– Dividend Yield: Compare the dividend yield of Hindustan Zinc with industry peers to assess its attractiveness.

– Dividend Growth: Evaluate the company’s track record of dividend growth and its potential for future increases.

– Payout Ratio: Analyze the dividend payout ratio to ensure the company can sustain its dividend payments.

– Financial Health: Assess the company’s balance sheet strength, cash flows, and profitability to gauge its ability to pay dividends.

Conclusion

In conclusion, Hindustan Zinc’s dividend payout reflects its commitment to rewarding shareholders and creating long-term value. By maintaining a healthy dividend policy and focusing on sustainable growth, the company continues to be an attractive investment option for those seeking consistent returns and capital appreciation.

Frequently Asked Questions (FAQs)

Q1. What is Hindustan Zinc’s dividend payout ratio?

A1. Hindustan Zinc’s dividend payout ratio varies year to year but has historically been around 30-40% of its profits.

Q2. How often does Hindustan Zinc pay dividends?

A2. Hindustan Zinc typically pays dividends annually, following the approval of its board of directors.

Q3. Can investors reinvest dividends in Hindustan Zinc’s stock?

A3. Yes, investors have the option to reinvest dividends through the company’s dividend reinvestment plan (DRIP).

Q4. How does Hindustan Zinc’s dividend yield compare to other companies in the metals and mining sector?

A4. Hindustan Zinc’s dividend yield is competitive within the metals and mining sector, offering an attractive income opportunity for investors.

Q5. Does Hindustan Zinc offer a dividend growth plan for long-term investors?

A5. While Hindustan Zinc does not have a formal dividend growth plan, the company has a track record of increasing its dividend payouts over time.

Q6. What regulatory considerations does Hindustan Zinc take into account when deciding on dividend payouts?

A6. Hindustan Zinc complies with all legal and regulatory requirements related to dividend distributions, ensuring transparency and accountability to its shareholders.

Q7. How does Hindustan Zinc’s dividend policy align with its long-term strategic goals?

A7. Hindustan Zinc’s dividend policy is a reflection of its commitment to shareholder value creation and sustainable growth, aligning with its long-term strategic objectives.

Q8. How does Hindustan Zinc manage the balance between dividend payments and reinvestment in growth opportunities?

A8. Hindustan Zinc carefully evaluates its capital allocation decisions to strike a balance between rewarding shareholders through dividends and reinvesting in strategic growth initiatives.

Q9. What are the tax implications for investors receiving dividends from Hindustan Zinc?

A9. Investors receiving dividends from Hindustan Zinc are subject to tax as per the prevailing tax laws in India, including dividend distribution tax.

Q10. How can investors stay updated on Hindustan Zinc’s dividend announcements and payouts?

A10. Investors can monitor Hindustan Zinc’s investor relations website, company announcements, and financial reports for updates on dividend declarations and payouts.

Comments